Overview

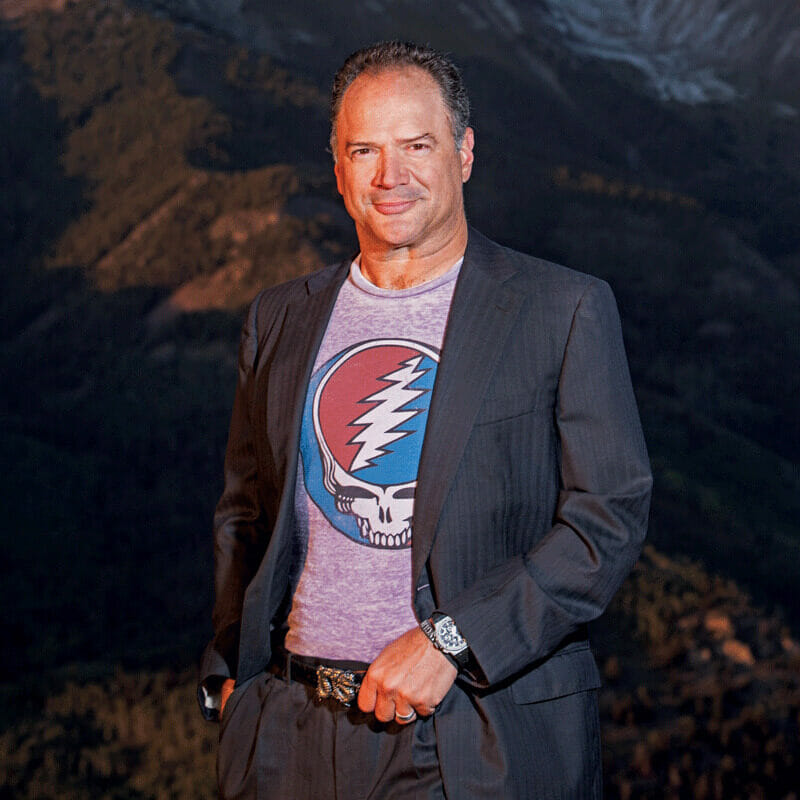

A “rockstar” and “powerhouse litigator.” “Relentless in the courtroom.” That’s what Chambers USA called me in its 2021 and 2020 Guides to America’s Best Lawyers. Lawdragon calls me “One of the great trial lawyers of his generation” and lists me among the 500 Leading Lawyers in America. Business Today has praised my, “interpersonal skills, writing ability, and sharp courtroom aptitude.” The National Law Journal featured me on its nationwide “Appellate Hot List 2020,” named me an “Energy Litigation Trailblazer” in 2017, and featured me as a “Winning Litigator” in 2016. The Legal 500 lists me among the country’s top lawyers for general commercial disputes and for energy litigation. The Best Lawyers in America named me one of the “Best Lawyers in America” for commercial litigation.

“Geoff is great with clients, adversaries and judges alike. He’s a straight shooter, great writer and even better on his feet . . . . He’s really good and smart.”

– As quoted in Chambers 2022 rankings

In its 2017 article calling Susman Godfrey “America’s Leading Trial Firm,” Lawdragon states, “Harrison has compiled an astounding track record of wins mixing commercial litigation and public interest cases,” called me and two others “a powder keg as trial lawyers” and “the dream team for whom any major firm would trade its current 50-year-old partner ranks,” and raved that one partner said “I’d take a bullet for him.” Law360 has also featured me as a “Trial Pro.”

“Geoffrey Harrison is a powerhouse litigator.” “One of the premier trial lawyers. He is absolutely fantastic and one of the rockstars at the firm. A go-to for us.”

– As quoted in Chambers 2021 rankings

I joined Susman Godfrey in 1993, made partner in record time in 1996, and have served on the firm’s Executive Committee for years. I handle high stakes appeals, arbitrations, bench trials, and especially jury trials all over the country.

“I cannot stress strongly enough how great he is,” enthused one of Harrison’s clients. “The guy’s just extremely thorough and smart but also extremely practical. He knows what he wants in a case and what to look for to make sure your case is presented. Very open about the good and bad aspects of our case, and extremely persuasive in court. He frequently represents key clients in federal court trials.”

– As quoted in Chambers USA 2014 rankings

Called “invaluable in the courtroom” and hired for “big bet-the-company-type cases” by clients interviewed in Chambers USA 2023’s rankings, I have considerable experience with accounting malpractice, antitrust, class action, construction, contract, domestic and international arbitrations, environmental exposure, equipment leasing, executive compensation, fiduciary duty, fraud, offshore oil exploration and well decommissioning, onshore and offshore oil and gas production and transportation, pension liability, petrochemical and pipeline construction and contract disputes, securities, shareholder derivative, toxic torts, trade secrets, and other types of litigation.

“Geoffrey Harrison is so good that it’s scary . . . . They are simply smarter, faster, more aggressive (when appropriate) and more strategically astute than their competitors. In my mind, they do not have a peer firm. They are the gold standard.”

– As quoted in Legal 500 2021 analysis

My high stakes commercial litigation practice includes disputes in Alaska, California, Delaware, Illinois, Louisiana, Minnesota, Mississippi, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Texas, and Washington, and includes international disputes in Brazil, England, France, Greece, Morocco, Slovenia, Spain, and Venezuela. I handle cases from start to finish, managing the litigation, serving as lead counsel at trial, and often handling and arguing appeals as well.

“Led by Susman Godfrey partner Geoffrey L. Harrison, the team . . . helped LyondellBasell ultimately recover just under $76 million from all sources.” LyondellBasell’s general counsel said the SG team “thrived and enjoyed the multifaceted nature of the engagement” and “relished looking at this from a 360 degree perspective,” and praised Harrison as a “fabulous trial lawyer.”

– As quoted in Law360’s 2014 article

Closer to home, I won a $40 million settlement for the City of Houston from Towers Watson & Co. in an actuarial negligence lawsuit based on pension benefits, and won a high profile jury trial and final judgment upholding the Houston’s Equal Rights Ordinance in the face of a repeal challenge—a win for which the Texas Lawyer called me “Houston’s HERO.” In 2015, the Texas Lawyer named me “Litigator of the Week” and “Appellate Lawyer of the Week.”

“After [Judge] Ellison ordered KBR to trial, the company hired a new defense team headed by Houston’s Geoffrey Harrison. Harrison was something of a gunslinger . . . . Harrison’s approach was more dispassionate. He limited his arguments to questions of the law . . . . He also radiated confidence. . . . [Opposing counsel] realized they were now up against a far more skilled litigator, one of the best attorneys KBR’s money could buy.”

– As quoted in The Girl from Kathmandu (HarperCollins 2018)

Notable Representations

- July 2023 — Won a Texas state court injunction hearing and defeated an attempt to enjoin Apache Corporation from drawing on and receiving payment from $498 million worth of letters of credit and surety bonds issued in connection with decommissioning offshore oil wells, platforms, and other facilities in the Gulf of Mexico. Four of the world’s largest insurance companies sued to enjoin Apache based on allegations of impaired collateral, altered bond risk, and breach of contracts. Two weeks after the insurance companies filed suit, the court held a three day, full evidentiary hearing with openings, five witnesses, closings, and lots of briefing. The court ruled for Apache and denied the injunction.

- July 2023 — Won a 3-0 decision in the U.S. Court of Appeals for the Eighth Circuit affirming a $4.8 million summary judgment for national leasing company Winthrop Resources Corporation against healthcare company Prospect ECHN, Inc. Prospect had sued to recover millions in lease payments it had made, sought to avoid paying millions more, and sought to recharacterize the lease agreement into a secured transaction. We counterclaimed for breach of contract. The Minnesota District Court conducted a pandemic-era Zoom hearing on cross-motions for summary judgment and, in September 2021, ruled for Winthrop across the board and awarded Winthrop every penny of the $4,824,490.49 in damages we sought plus $582,000 in attorney’s fees and costs. The court noted that “Mr. Harrison’s presentation at the motions hearing was effective and very important to Winthrop’s success” and called me a “talented litigator.”

- January 2023 — Settled a $100-plus million patent infringement lawsuit against Samsung Electronics on the morning of jury selection in the Western District of Texas. Our client Proxense, LLC’s technology enables biometric authentication on mobile-pay applications like Samsung Pay. We secured favorable Markman rulings, defeated Samsung’s summary judgment motions (including those masquerading as motions in limine), and secured a partial plaintiff-side summary judgment ruling as well. The terms of the settlement are confidential.

- September 2022 — Represented energy industry midstream companies in two Oklahoma lawsuits against an EPC contractor for multiple pipelines. The contractor sued for $20 million in withheld retainage and, to prevent a counterclaim, sued the parent/guarantor and not the operating company. We had the operating company sue the contractor for $65 million due to delays, engineering and construction errors, and contract breaches, and persuaded the Court to consolidate the lawsuits based on what the Court called our “analysis and well written response brief.” We defeated the contractor’s motion to dismiss, engaged in extensive discovery, and resolved the dispute on a basis the contractor insisted be kept confidential.

- June 2022 — Won a Texas state court trial for a litigation funder private equity firm against a law firm and counsel who disputed the validity and scope of a contract. The court granted the exact declaratory judgment we requested, found that our funder client prevailed on the main issues in the case, and awarded nearly $1 million in attorneys’ fees and expenses plus over $200,000 more on appeal. The win confirmed the validity of our client’s lien on the gross amount of certain attorneys’ fees in connection with over 1,000 Engle and other tobacco cases in Florida courts, and protected our client’s expected receipt of tens of millions of dollars linked to the outcome of the underlying tobacco cases.

- December 2021 — Represented a global energy industry company in a confidential executive compensation arbitration and obtained a finding that the executive’s actions “constituted gross misconduct” that the executive “could not have reasonably believed was in the best interests of the company.”

- January 2021 — Served as special litigation counsel for debtor Arena Energy, LP and sought a TRO requiring would-be bidders W&T Offshore and 31 Group to return or destroy all confidential information they improperly obtained from Arena’s virtual data room. Immediately after the TRO hearing, W&T and 31 Group capitulated and signed a settlement agreement granting Arena the relief we sought. At a subsequent evidentiary hearing, the bankruptcy court declared W&T’s conduct “abhorrent to the Court.”

- August 2020 — Defended several oil and gas limited partnerships and certain of their owners against two limited partner plaintiffs’ Texas state court lawsuit for breaches of a partnership agreement, breaches of fiduciary duty, and demand for over $100 million in damages. We took over from another law firm, quashed plaintiffs’ discovery requests, and persuaded the court to compel arbitration of all claims. We filed our own arbitration demand, asserted affirmative claims for declaratory and monetary relief, and defeated the limited partners’ contract-based motion for advancement of attorney’s fees. After significant motion practice, the limited partners abandoned all claims and walked away with zero dollars.

- December 2019 — Won a multi-million dollar award (100% of damages sought plus fees, costs, and interest) in a confidential technology and construction industry arbitration involving obligations under a written agreement. The parties’ names, location of the project at issue, nature of the dispute, and specifics about the award are confidential.

- July 2019 — Argued and won a 3-0 decision from the U.S. Court of Appeals for the Fifth Circuit affirming a nearly $50 million judgment in favor of Apache Deepwater LLC against W&T Offshore for W&T’s failure to pay its share of the costs to plug and abandon three deepwater wells in the Gulf of Mexico. We secured the judgment for Apache by winning a $43.2 million jury verdict after a two week trial in 2016, plus attorney’s fees and interest. W&T also paid Apache $24.8 million shortly after we filed the lawsuit for a gross recovery of nearly $75 million and, after fees and expenses, a net recovery of nearly $63 million. Click here for the Texas Lawyer article on the Fifth Circuit’s decision.

- June 2018 — Defended an investment management firm against a variety of claims asserted by former partners based on their allegations of contract breaches, misrepresentations and supposed unethical conduct. We aggressively brought the fight to the plaintiffs by persuading the court to compel arbitration and abate plaintiffs’ case, initiating arbitration and filing our own multi-million dollar claims, securing a rapid hearing schedule, compelling production of withheld documents, and moving for summary judgment. Far from paying the many millions of dollars that plaintiffs sought, we obtained a confidential settlement (we may say that “each side is satisfied”) and obtained a signed court order reciting that plaintiffs “withdrew and did not present evidence to support allegations about [our client’s] alleged ‘unethical behavior.’” That’s better than a letter of apology.

- April 2018 — As lead counsel for the City of Houston, secured a $40 settlement payment from actuarial firm Towers Watson & Co. to resolve the City’s federal court allegations of negligence and negligent misrepresentation arising out of actuarial work on benefits changes for one of the City’s pension funds.

- April 2017 — As lead counsel for a SunPower Corporation Systems, settled a $75 million lawsuit in California state court against a major energy company arising out of a construction and financing agreement for the development of a large-scale solar energy power plant. The dispute involved the parties’ rights, indemnity obligations, and financial exposure in connection with a multi-hundred million dollar shortfall in the amount of anticipated funding from the federal government. The case settled 2 ½ weeks before trial and, while the settlement is confidential, we are allowed to say that the litigation was resolved on mutually agreeable terms.

- March 2017 — Settled a $20 million breach of contract lawsuit over a project to expand the capacity of an ethylene and propylene chemical plant. Our petrochemical industry client alleged that the contractor, a global engineering services and construction company, breached the parties’ engineering and procurement contract by failing to meet industry and contractual standards and failing to comply with its warranties. Armed with a detailed certificate of merit prepared by our professional engineering experts, we also alleged claims for negligence and engineering malpractice based on the contractor’s schedule mismanagement, delays, failure to use 3D laser scans, and problematic structural and isometric drawings. The settlement agreement does not allow disclosure of the parties’ names and the dollar amount of the settlement.

- January 2017 — Argued and won a decision in the U.S. Court of Appeals for the Fifth Circuit affirming a district court summary judgment I won for KBR, Inc. against claims brought by a group of plaintiffs’ lawyers in which they (improperly) tried to hold KBR, Inc. vicariously liable for certain conduct of other companies that the plaintiffs’ lawyers sought to characterize as violations of the Trafficking Victims Protection Act and Alien Tort Statute. Plaintiffs’ claims arose out of a tragic war-time incident in which Iraqi insurgents kidnapped and executed 12 men who had traveled from Nepal to work at a U.S. military base in Iraq. We highlighted the schism between the facts and plaintiffs’ counsel’s allegations, focused the district court’s attention on plaintiffs’ counsel’s various discovery failings, staved off attempts to obtain overly broad discovery, and thoroughly explored the U.S. Supreme Court’s jurisprudence on the extraterritorial application of federal statutes and retroactivity.

- October 2016 — Won a $43.2 million federal court jury verdict and $48.7 million final judgment for Apache Deepwater LLC against W&T Offshore based on W&T’s failure to pay its share of the costs to plug and abandon three deepwater wells in the Gulf of Mexico. Apache was the operator and safely plugged and abandoned the wells in compliance with federal regulations. W&T refused to pay its share because it disagreed with Apache’s decision to use drilling rigs rather than accepting W&T’s proposal to use an intervention vessel that the evidence showed was less capable and more risky. Apache’s $48.7 million judgment comes on top of a $24.8 million partial payment W&T made 2 ½ months after Apache filed this lawsuit, making Apache’s potential gross recovery about $75 million including interest. This was one of National Law Journal’s Top 100 Verdicts of 2016.

- February 2016 — Argued and won a 3-0 decision in the U.S. Court of Appeals for the Fifth Circuit affirming the district court’s judgment in favor of Apache Corporation and against W&T Offshore. The appeal arose out the jury’s verdict and the court’s partial summary judgment in favor of Apache—I was Apache’s lead trial lawyer as well—rejecting W&T’s $20 million claim for misallocation of offshore oil and gas production in the Gulf of Mexico. We won the jury’s verdict, won the court’s judgment, won the appeal, and recovered over $100,000 in court costs from W&T.

- October 2015 — Served as KBR, Inc.’s lead trial lawyer and won summary judgment against all claims asserted by over 160 national guard combat troops who sought over $1 billion in damages based on alleged chemical exposure during the Iraq War while deployed by the U.S. Army to provide force protection at an Iraq-owned water treatment plant. In March 2017, the U.S. Court of Appeals for the Fifth Circuit issued a 3-0 decision, held that plaintiffs failed to prove causation, and affirmed KBR’s summary judgment win. This complex lawsuit involved threshold personal and subject matter jurisdiction questions involving the political question doctrine and combatant activities preemption, a four week jury trial in federal court in Oregon, years of litigation in a companion lawsuit in federal court in Texas, appeals in the U.S. Courts of Appeals for the Fifth and Ninth Circuits, and a host of complex medical, scientific, and merits-based issues. KBR won its appeal to the Ninth Circuit, secured a transfer of the Oregon case to Texas, won summary judgment and dismissal of all claims brought by all the plaintiffs, and won final judgment in favor of KBR.

- September 2015 — Argued and won a 3-0 decision in the U.S. Court of Appeals for the Fifth Circuit that a $122.9 million court judgment from the Kingdom of Morocco is worthy of recognition and enforcement in Texas against billionaire John Paul DeJoria. The Fifth Circuit rejected DeJoria’s multiple attacks on the Morocco judgment—due process, reciprocity, personal jurisdiction, inconvenient forum, and public policy attacks—and held that DeJoria failed to meet his burden of proving non-recognition under Texas’s Uniform Foreign Money Judgments Recognition Act. After we won in the Fifth Circuit, DeJoria lobbied the Texas legislature to change the law and apply it retroactively to his case and, under the new Act, escaped liability.

- April 2015 — Successfully defended Targa Liquids Marketing & Trade against Plains Gas Solutions’ multi-party Texas state court lawsuit involving allegations about gas supply and pipeline transportation from the Gulf of Mexico to onshore processing and fractionation facilities. In response to Plains’ claims and threat to seek over $100 million in damages for supposed tortious interference, Targa filed and pursued counterclaims for breach of contract and declaratory judgment. The parties settled on terms that Plains insisted be kept confidential although, interestingly, Plains filed a post-settlement amended petition against the remaining defendants alleging they “cause[d] Plains to owe millions in deficiency fees to Targa.”

- March 2015 — Won $19.4 million award (100% of damages sought, plus interest) after a final hearing for client Eni Petroleum US in a confidential energy industry arbitration regarding cost allocation among working-interest owners in deepwater Gulf of Mexico oil exploration and production activities under joint operating agreement..

- February 2015 — Won a three week jury trial for the City of Houston against a group of plaintiffs seeking to repeal Houston’s Equal Rights Ordinance (“HERO”) which prohibits discrimination based on sex, race, color, ethnicity, national origin, age, familial status, marital status, military status, religion, disability, sexual orientation, genetic information, gender identity, or pregnancy. In a resounding win for the City, the jury found that 64 out of 97 petition circulators failed to comply with the legal requirements in the City Charter—exactly as we asked the jury to find—and found that 12 of the 13 circulators who gathered the most signatures submitted pages with forgeries and false oaths. Sadly, the voters rejected the ordinance months later.

- February 2015 — Won a federal court summary judgment for national leasing company Winthrop Resources Corporation against international telecom company Commscope, Inc. in a multi-million dollar dispute over the terms of a lease. We preemptively filed a declaratory judgment suit in the Western District of North Carolina in response to Commscope’s multiple threats to sue our client, secured FRCP 12(b)(6) dismissal of all Commscope’s extra-contractual counterclaims, successfully moved to compel the company to fly one of its executives half-way around the world from Seoul, Korea to answer 20 deposition questions he had been instructed not to answer, and ultimately won summary judgment “in its entirety” for Winthrop, wiping out Commscope’s multi-million dollar counterclaim, and winning an award of our attorney’s fees and expenses.

- December 2014 — Won a two week federal court jury trial for Apache Corporation and defeated W&T Offshore’s multi-million dollar breach of contract claims arising out of the allocation of offshore oil and gas production in the Gulf of Mexico. It took the jury a short 45 minutes to return its verdict finding that Apache fully complied with the parties’ contract and rejecting W&T’s claims. Before trial, we won a partial summary judgment for Apache against W&T’s fraud, conversion, and other claims, and knocked the alleged damages down from $20 million to $4.7 million. The court agreed with us that the bulk of W&T’s “windfall” damages theories were based on an “impossible result” and were “unreliable as a matter of law.”

- April 2014 — Successfully settled Apache Corporation’s fraud, breach of contract, and declaratory judgment claims against a multinational energy industry services provider, W&T Offshore, and others, in connection with claims brought by several other energy companies against the services provider for grossly negligent cement and well completion services. The services provider turned around and demanded indemnity from Apache for the services provider’s misconduct based on its misinterpretation and attempted misapplication of a decades-old master services contract. We alleged that the services provider, W&T Offshore, and others colluded by trying in bad faith to craft a settlement of the underlying gross negligence lawsuit against the services provider in such a way as to have Apache (a non-party to that lawsuit) rather than the services provider itself fund the settlement—the old “try to circle ‘round to the back door when you can’t go in the front” maneuver. A mere eight days after we filed Apache’s lawsuit, we had a signed settlement agreement with terms that the other parties insisted be kept confidential.

- December 2013 — Conducted an internal investigation into a kickback scheme and other improprieties perpetrated by a former employee of our petrochemical company client. We compiled substantial evidence establishing that the former employee and certain of his coconspirators had engaged in tortious and illegal conduct in an international conspiracy involving conduct in Belize, the British Virgin Islands, Greece, Switzerland, the U.S., and Venezuela. We filed civil lawsuits against several national and international defendants, asserted pre-lawsuit civil claims against other potential defendants, handled associated insurance disputes, and recovered nearly $70 million in cash. The specific amounts recovered from certain defendants are confidential. We also provided information and assistance to the U.S. Attorney’s office which secured plea agreements from multiple participants in the kickback scheme, including multi-year prison sentences, and $139 million in civil forfeiture awards. Click here to read excerpts about this matter in Law360’s article titled “Most Feared Plaintiffs Firm: Susman Godfrey.”

- February 2012 — Won a federal court case for Apache Corporation authorizing Apache to exclude a purported shareholder’s proposal from its proxy materials. Soon after Apache filed suit, we challenged the defendant’s eligibility and shareholder status, and sought a speedy hearing, the defendant offered judgment in favor of Apache.

- November 2011 — Settled a $48 million negligence case on behalf of our client Houston Refining LP against the owner and operator of one of the largest cranes in the world whose crane collapsed in Houston Refining’s industrial facility. Before we were hired, the crane company had won a partial summary judgment eliminating over 95% of Houston Refining’s damages. We developed additional facts, argued within a different legal framework, and persuaded the court to vacate its partial summary judgment. The case settled on confidential terms two weeks before trial.

- April 2011 — Won a federal court trial for KBR, Inc. authorizing KBR to exclude a purported shareholder’s proposal from its proxy materials. KBR filed suit in federal court, sought a speedy hearing, and sought a declaration that it properly may exclude the proposal from its proxy materials under Rule 14a-8(b) because the purported shareholder failed to prove his status as a shareholder and his eligibility to submit a proposal. The court ruled in KBR’s favor. We won in the Fifth Circuit too.

- November 2010 — Won a $4-plus million judgment on the jury’s verdict for Frankel Offshore Energy against three of its former energy industry business partners. After a two week trial, the jury found that defendants engaged in fraud, breached their fiduciary duties, and breached multiple contracts with Frankel Offshore, and the court entered judgment based on the jury’s verdict. The judgment was reversed on appeal. Before trial, we had settled for confidential amounts with other parties, including oil and gas exploration and production company Probe Resources US Ltd. and private equity firm Warburg Pincus LLC.

- October 2010 — Settled during trial a multi-million dollar breach of contract lawsuit in which we argued to the jury that our multinational chemical manufacturer client’s freight forwarding company had failed to comply with the parties’ written contract by charging fees we claimed the contract did not allow. Before trial, we obtained a plaintiff-side summary judgment ruling on liability, and we went to trial on defendant’s affirmative defenses and on the issue of damages. We settled the case at the end of the first week of trial, and we agreed to keep the specific terms of the settlement confidential.

- March 2010 — Won a federal court trial for Apache Corporation authorizing Apache to exclude a purported shareholder’s proposal from its proxy materials. Instead of following the normal course of obtaining a “no action” letter from the SEC, Apache filed suit in federal court, sought a speedy hearing, and sought a declaration that it properly may exclude the proposal from its proxy materials under Rule 14a-8(b) because the purported shareholder failed to prove his status as a shareholder and his eligibility to submit a proposal. The proposal had been submitted by John Chevedden, a person Apache described in its pleadings as the “single most persistent proponent or proxy of purported shareholder proposals in history.”

- January 2010 — As lead counsel for a global engineering, construction and services company, KBR, Inc., and for the company’s directors, I successfully persuaded plaintiffs to dismiss their purported $550 million shareholder derivative class action claims against our clients. Through informal discussions and negotiations, and through formal procedural motions (such as special exceptions, motions to dismiss, removal to federal court) we persuaded plaintiffs that their claims were legally and factually flawed and not worth pursuing.

- April 2009 — Won dismissal from the Delaware Chancery Court of a shareholder derivative lawsuit brought against our clients, certain officers and directors of an offshore oil services industry company. We worked cooperatively with counsel for the company’s special litigation committee in seeking, and securing, dismissal of the plaintiff shareholders’ complaint. We also defended these officers and directors in a similar shareholder derivative lawsuit filed in Texas state court.

- April 2008 — Won a federal court bench trial for Apache Corporation against several New York-based pension fund shareholders who sought to have Apache include an improper shareholder proposal in its proxy materials. After the funds’ trustee issued a press release criticizing the SEC staff for issuing the “no action” letter agreeing with Apache, we filed suit, requested a speedy hearing, and sought a declaratory judgment that Apache properly had excluded the shareholder proposal based on Rule 14a-8 and based on the SEC staff’s “no action” letter. Two weeks after we filed suit, we won a full trial on the merits and the court ruled in Apache’s favor from the bench.

- March 2008 — Settled the patent infringement claims of a generic pharmaceutical manufacturing company against a large pharmaceutical company that manufactured and sold the brand-name drug. We argued that the brand-name pharmaceutical company’s manufacture and sale of its brand-name drug infringed two of our generic pharmaceutical company’s patents. We settled the case less than a year after we served the lawsuit and during active document discovery. The terms and amount of the settlement are confidential.

- December 2007 — A foreign start-up company sued our international energy company client for alleged tortious interference with an alleged contract to explore and develop an offshore oil and gas field in the waters of Trinidad. Through investigation outside the traditional discovery channels, we discovered that the plaintiff company was run by executives with a remarkable track record of failure, a penchant for living off shareholder money, and other questionable attributes. We filed a motion for summary judgment and, while the motion was pending, settled the case for less than half a penny on the dollar of the damages plaintiffs told the court they were seeking.

- October 2007 — Argued and won in the Texas Supreme Court on behalf of our client Forest Oil Corporation. We sought to compel arbitration of various plaintiffs’ claims for alleged environmental contamination, intentional battery from allegedly radioactive oil well tubing, and other specious claims. Plaintiff James A. McAllen, Jr. and others filed suit in McAllen, Texas, the city named after McAllen’s ancestors. The Texas Supreme Court stayed the case and then ruled in Forest’s favor on the need for arbitration. Click here to watch my oral argument before the Texas Supreme Court.

- August 2007 — Settled a multi-hundred million dollar accounting malpractice case against one of the world’s largest accounting firms. We represented a foreign industrial conglomerate that had acquired a U.S. company based in large part on the accounting firm’s certification of the company’s misleading (as it turns out) financial statements. After defeating multiple motions for summary judgment and to strike our experts, we settled the case on the Friday before the jury trial in New Jersey state court was set to begin. The amount of the settlement is confidential.

- June 2007 — Settled an executive compensation lawsuit brought by our energy industry client’s former CEO who alleged breach of his employment and stock option agreements. We counterclaimed based on termination for cause and sought cancellation of the executive’s stock options plus repayment of millions in compensation. We filed an affirmative motion for summary judgment to establish our entitlement to this recovery as a matter of law. While the motion for summary judgment was pending, we settled for a fraction of the amount the former CEO sought.

- October 2006 — Negotiated an amicable resolution to a licensing agreement dispute between Tracey Technologies Corp. and Advanced Medical Optics, Inc. The terms of the resolution are confidential, except that the parties issued a joint press release in which they announced that “AMO will have a world-wide, non-exclusive license to Tracey Technologies’ ray tracing wavefront technology under a new licensing agreement.”

- July 2006 — Settled several executive compensation, employment agreement, and stock option agreement disputes on behalf of an international oil services industry company. Former CFOs and other officers and employees filed suit or otherwise asserted claims seeking compensation under various employment and option related agreements. While the terms of each of the various settlements are confidential, the settlements generally were at steep discounts to the amounts of the claims asserted.

- January 2006 — Settled the multi-million dollar antitrust claims of Chevron Phillips Chemical Company and Chevron Oronite against four international parcel tanker shipping companies. We initiated separate arbitrations and asserted that the shipping companies violated antitrust laws by conspiring to increase prices and allocate markets and trade lanes to the financial detriment of our clients and other chemical companies. We secured eight different confidential settlements.

- December 2005 — Settled the multi-million dollar claims of T.C. Petroleum, Inc. against Canadian Natural Resources Limited. In an ICC arbitration in Paris, France, T.C. Petroleum asserted that Canadian Natural Resources and certain of its affiliates committed fraud and breached their contractual obligations to provide T.C. Petroleum with a carried interest in a large oil field off the coast of the Cote d’Ivoire in Africa. The parties settled their dispute just weeks before the arbitration hearing on the merits was scheduled to begin in Paris. The terms of the settlement are covered by a rather strict confidentiality provision that permits only this disclosure: T.C. Petroleum and Canadian Natural Resources “have amicably settled all their disputes and differences to the mutual satisfaction of all parties.”

- February 2005 — Settled a $48 million securities fraud case against Waste Management, Inc. on behalf of shareholders who opted out of a federal class action settlement. We filed suit in Texas state court and developed theories of liability and evidence that had evaded the class plaintiffs. We claimed that Waste Management violated Sections 11 and 12 of the 1933 Securities Act, violated the Texas Securities Act, and made fraudulent and negligent misrepresentations in its June 1998 Proxy Statement in connection with its $20 billion merger. We defeated multiple summary judgment motions and filed our own plaintiffs-side partial summary judgment motion on liability. We settled the case for more than 40 times what our clients would have received in the class action settlement. At Waste Management’s insistence, the actual amount of the settlement is confidential.

- September 2004 — Settled the multi-million dollar federal court claims on behalf of our insurance industry clients against Deutsche Bank AG, Lehman Brothers Inc. and others based on alleged violations of federal and state securities laws in connection with the sale of $245 million worth of asset-backed securities. We alleged that Deutsche Bank and Lehman misrepresented the “rigorous and conservative approach” in their underwriting. We survived motions to dismiss and then settled the case for an amount that defendants insisted be kept confidential.

- January 2004 — Won a $3.2 million jury verdict for Apache Corporation against two gas processing affiliates of Dynegy, Inc. We alleged that the Dynegy affiliates breached 18 different gas processing contracts by failing to account and pay for over 400 million cubic feet of gas. The jury found for Apache on every issue and found that the Dynegy affiliates breached all 18 contracts and willfully engaged in deceptive and unfair trade practices. The Dynegy affiliates had paid Apache an additional $1.38 million before trial. After a partial JNOV and a modification of the judgment in the court of appeals, the Texas Supreme Court heard argument on several issues, and ruled for Dynegy. Click here to watch my September 2008 oral argument before the Texas Supreme Court.

- June 2003 — Settled a $20 million breach of contract and fraud case brought by our client, France-based Hexamedics, S.A.R.L., against two of the world’s largest pacemaker manufacturers, Guidant Corp. and Intermedics, Inc. We filed suit in federal court in Minneapolis and alleged that Guidant and Intermedics improperly poached Hexamedics’ sales representatives and cut off its supply of pacemakers en route to driving Hexamedics out of business. We settled the case a few months after surviving defendants’ motion for summary judgment and two weeks before our trial date. The amount of the settlement is confidential.

- February 2003 — A national Minnesota-based computer equipment leasing company called us after its lessee, a Texas-based seismic data company, had obtained an ex parte TRO that prevented the leasing company from retaking possession of millions of dollars’ worth of its leased equipment. After expedited discovery and a one day mini-trial, we persuaded a Texas court to deny the lessee’s request for an injunction and, better yet, to dismiss its entire lawsuit. We then filed our own lawsuit in Minnesota against the delinquent lessee to enforce our Lease Agreement. We settled the case just seven months later with the lessee agreeing to pay our client over $7.8 million, including payment of our attorneys’ fees.

- September 2002 — Won an appeal in the U.S. Court of Appeals for the Fifth Circuit, and persuaded the Fifth Circuit to reinstate a $120-plus million breach of contract claim against Lucent Technologies, Inc. The Fifth Circuit held that the federal district court erred by dismissing claims brought against Lucent by the former owners of Herrmann Technology, Inc., a company Lucent had purchased with stock then worth over $400 million. The Fifth Circuit held that the former owners properly had stated a claim for breach of contract and remanded the claim to the district court for further proceedings. We settled the case ten months after the Fifth Circuit issued its ruling. The amount of the settlement is confidential.

- March 2002 — Won a $21.5 million summary jury trial verdict in favor of Dallas based Tera-Force Technologies, Inc. against Silicon Valley based Cadence Design Systems, Inc. Tera-Force sued Cadence for breach of a multi-million dollar Asset Purchase Agreement that Cadence claimed never became effective. At the court’s urging a month before trial, the parties conducted a one day nonbinding “summary jury trial” in which the parties picked an actual jury and presented their evidence and witness testimony in the courtroom with the actual judge presiding. The jury’s $21.5 million damages award opened Cadence’s eyes about its potential exposure, and we settled the case the next day. Our thrilled client had its day in court, recovered an excellent settlement, and avoided years’ worth of promised appeals. Texas Lawyer featured this settlement as one of the “Top 10 Settlements in Texas in 2002.”

- July 2001 — Won a $5.7 million executive compensation arbitration award for a former president and COO against his former employer, Budget Rent-A-Car. The seven day arbitration took place in Chicago and involved claims made under an executive compensation agreement following the executive’s purported “for cause” termination. The arbitrator agreed with us and found that the termination was without cause, awarded our client a multiple of his attorneys’ fees, and awarded him more money than he would have been paid if Budget had honored the executive compensation agreement in the first place.

- January 2000 — Medtronic, Inc. hired us to take over as lead trial counsel to defend it in a billion dollar antitrust case just six weeks before trial in federal court in Houston. The plaintiff, Sulzer Intermedics, Inc., alleged that Medtronic conspired to monopolize the U.S. pacemaker market and committed various torts along the way. We persuaded the court to grant summary judgment against all of the antitrust claims and some of the tort claims. Then, in early March, we settled what little was left of the case for pennies on the dollar. The amount of the settlement is confidential.

- June 1999 — Settled a breach of fiduciary duty and fraud lawsuit brought by our two shareholder clients against Central Asian Petroleum and an Indonesian businessman. We alleged that the defendants engaged in a series of ownership interest shifting corporate shenanigans to eliminate our clients’ 20% interest in a large undeveloped oil and gas field in Kazakhstan. We settled the case for $6.25 million just four months after we filed it.

- November 1998 — Successfully defended mid-west public utility NIPSCO Industries, Inc. against a $30 million breach of contract claim in federal court in Chicago. We settled the case after a two week jury trial and just before closing arguments. NIPSCO was extremely happy with the settlement, while the plaintiff’s lawyers were so sensitive about the low amount that they insisted that our firm not publicize it.

- October 1998 — Successfully defended a software licensor in an arbitration in New York brought by a major national information systems company that had licensed the software. After one day of arbitration, we settled the case with the plaintiff company agreeing to pay our client cash and continuing royalties. The terms of the settlement are confidential.

- July 1998 — Settled a $25 million accounting malpractice lawsuit brought by our client, the former owner of world-wide travel agency Lifeco Services Corp., against Ernst & Young. We alleged that Ernst & Young negligently advised our client on a major corporate restructuring and tried to conceal the effects of its negligent work. The amount of the settlement is confidential.

- July 1998 — Settled a state-wide consumer class action against a major national direct marketing company for alleged violations of the Debt Collection Act. The case settled a few months after we persuaded the trial court to certify the case as a class action and to enjoin the defendant from continuing its allegedly illegal practices.

- February 1998 — Won a no liability verdict for The Hertz Corporation in a high profile jury trial in which the plaintiff alleged violations of state insurance licensing laws and unfair and deceptive practices. In less than an hour of deliberations, the jury found for Hertz on all issues and rejected plaintiff’s claims for attorneys’ fees. Earlier in August 1997, we defeated plaintiff’s motion to certify the case as a class action.

- October 1997 — Successfully defended NIPSCO Industries, Inc. against claims for breach of an alleged joint venture and minority shareholder oppression. Plaintiffs were shareholders in an oil and gas marketing company owned 51% by NIPSCO, and sought $65 million plus exemplary damages. After two weeks of trial, plaintiffs settled for pennies on the dollar, not even enough to make their contingent fee lawyers whole.

- September 1997 — Settled a $250 million lawsuit brought by our client, Telecom 21 L.L.C., a small telecommunications company, against Lucent Technologies, Inc. and AT&T Corp. We alleged that Lucent and AT&T breached their joint venture and fiduciary obligations to convert a former Soviet nuclear missile tracking site into a civilian wireless telecommunications network in Kazakhstan. Lucent agreed to settle the case only seven months after we filed suit. The terms of the settlement are confidential.

- December 1996 — Won a no liability arbitration ruling for two natural gas pipeline affiliates of Enron Corp. on claims of fraud and breach of contract brought by a natural gas producer. Plaintiff sought $20 million plus exemplary damages. After three days of evidence and argument, an arbitration panel rejected plaintiff’s claims and ruled for us on all issues.

- October 1996 — Won a no liability jury verdict for three natural gas pipeline affiliates of Enron Corp. against claims of fraud and breach of contract brought by 57 natural gas producers. The same lawyers who handled the arbitration above also tried this case. Most of the 57 plaintiffs abandoned their claims before trial. The remaining plaintiffs sought $88 million in actual and exemplary damages. After three weeks of trial, the jury rejected all of plaintiffs’ claims and we won on all counts.

- December 1995 — Won a $1.3 million jury verdict for the Teacher Retirement System of Texas against a Washington D.C. mortgage bank for breach of contract and breach of fiduciary duty. We alleged the bank misappropriated pension funds from Teachers in breach of its service contract and then tried to cover up its wrongful conduct. The trial lasted two weeks.

- October 1995 — Won a temporary restraining order and a temporary injunction in federal district court in St. Croix that returned our clients to their positions as directors and officers of Atlantic Tele-Network, Inc., the phone company for the U.S. Virgin Islands and Guyana. Our clients had been removed from their posts in violation of the federal securities rules through an improper secret consent solicitation.

- October 1995 — Successfully defended former directors and officers of Atlantic Tele-Network, Inc. against a breach of contract claim brought in Delaware Chancery Court by a group of newly installed directors. In light of our success in St. Croix, the case settled on excellent terms before the Delaware court issued its ruling. Our clients regained their corporate posts and suffered no liability.

- November 1994 — Won a $1 million verdict for Tri-Systems Corp., a local manufacturer of heat tracing cable, against two former salesmen. We alleged the salesmen breached their fiduciary duties, misappropriated trade secrets, and secretly set up a competing company to steal away our client’s customers. After a three day trial, the jury found for our client and rejected the salesmen’s $600,000 counterclaim.

- November 1993 — Won a $77.6 million accounting malpractice verdict against Deloitte & Touche in Texas state court. This was my first trial, and my partner Lee Godfrey and I represented a class of 10,358 limited partner investors in a limited partnership formed as a tax shelter to engage in agriculture and food production. We alleged that Deloitte was negligent and grossly negligent in its preparation of the partnership’s tax returns by including a multi-million dollar “pasturage deduction” for the cost of keeping 800,000 head of cattle at pasture. We demonstrated at trial that there were no records to support the pasturage deduction, that Deloitte knew this, and that the alleged cows never were at pasture. The trial court entered judgment for $79 million, but the court of appeals reversed the judgment based on a new post-judgment statute of limitations opinion in an unrelated case.

Honors & Distinctions

Honors and Awards

- Lawdragon 500 Global Plaintiff Lawyer (2024)

- Top Ten Trailblazing Commercial Litigators in Houston, Business Today (2023)

- Lawdragon Leading Litigator (2022, 2023)

- Lawdragon Legend (2021)

- Lawdragon 500 Best Lawyers in America (2015–present)

- Litigation Star, Benchmark Litigation (2022, 2023 Euromoney)

- Chambers USA’s Guide to America’s Leading Lawyers and Guide to the Nation’s Best Lawyers (2013–present)

- Leading Lawyer, Energy Litigation, The Legal 500 (2015–present)

- Leading Lawyer, General Commercial Disputes, The Legal 500 (2020)

- Appellate Hot List, National Law Journal (ALM, 2020)

- Top 100 Lawyers in Houston, Texas Super Lawyers (Thomson Reuters, 2020)

- U.S. News Best Lawyers in America, Commercial Litigation (Woodward White, 2017–present)

- U.S. News Best Lawyers in America, Appellate (Woodward White, 2022-present)

- Energy Litigation Trailblazer, National Law Journal (ALM, 2017)

- Winning Litigator, National Law Journal (ALM, 2016)

- Trial Pros, Law360 (2016)

- Texas Super Lawyer, Law & Politics Magazine (Thomson Reuters, 2004–present)

- Top Lawyers of Texas, Law & Politics Magazine (Thomson Reuters, 2012)

Clerkships

- Honorable Gerald Bard Tjoflat, Chief Judge, United States Court of Appeals for the Eleventh Circuit, 1992-1993

Education

The University of Chicago Law School (J.D., high honors, 1992)

- Order of the Coif (1991-1992)

- The University of Chicago Law Review, Associate Comment Editor (1991-1992)

- Thomas R. Mulroy Award for Excellence in Appellate Advocacy (1992)

- Karl Llewellyn Memorial Cup Winner in Moot Court (1992)

- Author: “The Endangered Species Act and Ursine Usurpations: A Grizzly Tale of Two Takings,” 58 U. Chi. L. Rev. 1101 (1991)

The University of Pennsylvania (B.A. in History, cum laude / B.S. in Economics, cum laude, 1989)

- Fourth in the World at the World Debate Championship (1989)

- Many wins at American Parliamentary Debate tournaments (1987-1989)

- Vice President, Sigma Alpha Mu fraternity (1987-1988)

Videos

References

Listed below are some people who have seen me at work, including clients who hired me, lawyers who tried cases or argued against me, and judges who have seen me in action often multiple times. These folks can talk about how I handle cases, the respectful way I interact with counsel and staff, and my process and prowess in the courtroom.

CLIENTS

- Celia Balli, KBR, Inc., Vice President of Litigation, 713-753-3889

- David Bernal, Apache Corporation, Assistant General Counsel, 713-296-6308

- Paul Gendler, TCF Capital Solutions, Managing Director, 952-656-7482

- Jeffrey Kaplan, LyondellBasell Industries, EVP & Chief Legal Officer, 713-309-7130

- Susan Lindberg, SemGroup Corporation, Former General Counsel, 918-595-4826

OPPOSING COUNSEL

- David Beck, Beck Redden, 713-951-6209

- Philip Eisenberg, Locke Lord, 713-226-1304

- Agnieszka Fryszman, Cohen Milstein, 202-408-4611

- Alex Romain, Milbank LLP, 424-386-4374

- Chris Reynolds, Reynolds Frizzell, 713-485-7202

JUDGES

- Hon. Michael Engelhart, Texas State Court, 151st Civil District, 713-927-2455

- Hon. Charles Eskridge, U.S. District Court for the Southern District of Texas, 713-250-5249

- Hon. David Hittner, U.S. District Court for the Southern District of Texas, 713-250-5511

- Hon. Lee Rosenthal, U.S. District Court for the Southern District of Texas, 713-250-5980

- Hon. Robert Schaffer, Texas State Court, 152nd Civil District, 832-927-2425

Admissions

Admissions

Bar Admissions

- Texas

- New York

Court Admissions

- United States Supreme Court

- U.S. Court of Appeals for the Fifth Circuit

- U.S. Court of Appeals for the Ninth Circuit

- U.S. Court of Appeals for the Eleventh Circuit

- Various Federal District Courts

Leadership & Professional Memberships

Associations

- American Bar Association

- Federal Bar Association

- Texas Bar Foundation, Life Fellow